Calculate Child Allowance ("Kinderfreibetrag") and Child Benefit ("Kindergeld") in Germany

The amount of child benefit ("Kindergeld") child allowance ("Kinderfreibetrag") depends on the number and age of the children.

Child benefit ("Kindergeld") is paid for all children up to the age of 18.

For children above 18 years, child benefit ("Kindergeld") is only paid under specific conditions.

When calculating child and spousal support, the paid child benefit ("Kindergeld") has to be taken into account.

For high incomes, the child allowance ("Kinderfreibetrag") can reduce the tax burden.

Content

Calculating Child Benefit ("Kindergeld") in Germany (as of 2025)

The amount of child benefit ("Kindergeld") in Germany changes frequently. This calculator takes into consideration the most updated

child benefit ("Kindergeld") entitlements and for earlier years since 2014.

Enter the number of children below the age of 18. If you have children above 18 years old, and

additional requirements

are met for these children, enter the number of these children as well. The first and second child receive the same amount

of child benefit ("Kindergeld"). However, if there are more than two children, the amount of child benefit ("Kindergeld") increases.

If you want to get the results of child benefit ("Kindergeld") for an earlier year select the year and press Calculate.

| 1. | Child: | 255 | € |

| 2. | Child: | 255 | € |

| 510 | € |

| 6120 | € |

The amount of total represents the monthly and annual entitlement to child benefit.

Additional conditions for children from 18 years old

For children below 18 years old child benefit ("Kindergeld") is paid without additional conditions.

For children between 18 to 21 years old child ("Kindergeld") benefit is only paid if at least one of the following additional requirements are fulfilled:

◾ Unemployed and registered as a jobseeker.

◾ Looking for an apprenticeship with evidence of trying without success.

◾ Undertaking training for an occupation, attending further schooling or university.

◾ Without any income due to physical, mental or psychological disability.

For children between 21 to 25 years old child benefit ("Kindergeld") is only paid if at least one of the following additional requirements are fulfilled:

◾ Looking for an apprenticeship with evidence of trying without success.

◾ Undertaking training for an occupation, attending further schooling or university.

◾ Without any income due to physical, mental or psychological disability.

For children above 25 years old child benefit ("Kindergeld") is only paid if following additional requirement is fulfilled:

◾ Without any income due to physical, mental or psychological disability that occurred before the age of 25

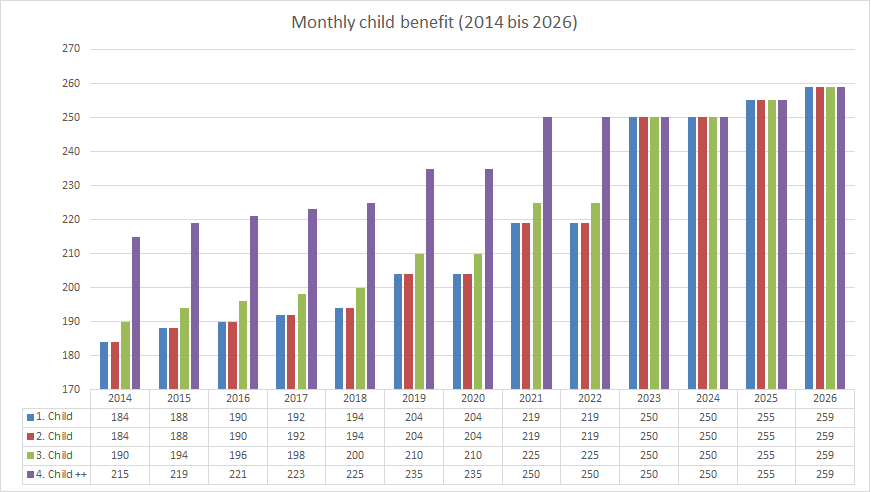

Development of Child Benefit Amount ("Kindergeldhöhe") in Germany

The development of child benefit ("Kindergeld") in Germany as of 2014 is shown for the first, second, third and fourth child.

The child benefit ("Kindergeld") for all further children corresponds to that for the fourth child.

Information on Child Allowance ("Kinderfreibetrag") and Child Benefit ("Kindergeld") in Germany

Child benefit ("Kindergeld") is paid monthly by the federal family benefits offices for all eligible children.

The Child allowance ("Kinderfreibetrag") is not paid out, but are taken into account in income tax. For high incomes, the child allowance can reduce the tax burden.

As part of the annual income tax assessment, the tax office checks whether the Child allowance ("Kinderfreibetrag") or the child benefit ("Kindergeld") paid out

is more favorable for the parents. This check is carried out automatically and does not need to be applied for. For parents who are assessed jointly for tax purposes,

the joint child allowance ("Kinderfreibetrag") applies, while for assessed, single, separated, or divorced parents, the child allowance per parent is taken into account.

The child allowance ("Kinderfreibetrag") consists of the allowance for the minimum subsistence level and the allowance for childcare, education, or training needs (BEA).

In general, both allowances are combined in the income tax assessment.

This child benefit calculator only offers an overview of claiming child benefit ("Kindergeld"). Further detailed information on the additional

requirements for child benefit ("Kindergeld") can be found in the

Child benefit leaflet

of the Family Benefits Office ("Familienkasse"). The Family Benefits Office is the German public office responsible for the

setting and payment of child benefit ("Kindergeld"). Here you will find

Forms and applications for child benefit (Kindergeld)